With a combined provision shortfall of Tk 1,954 crore through June of this year, sixteen non-bank financial institutions (NBFIs) saw a decline in their financial stability.

Lenders experience provision shortages due to a high percentage of non-performing loans (NPLs). Their net profit is eventually impacted. Inadequate financial management is evident when a lender experiences shortages in funding.

NBFIs must maintain current provisions against general category loans, with amounts ranging from 0.25 percent to 5 percent, 20% against substandard category loans, and 50% against doubtful category loans.

Loans classified as bad or loss-making require a 100% deposit.

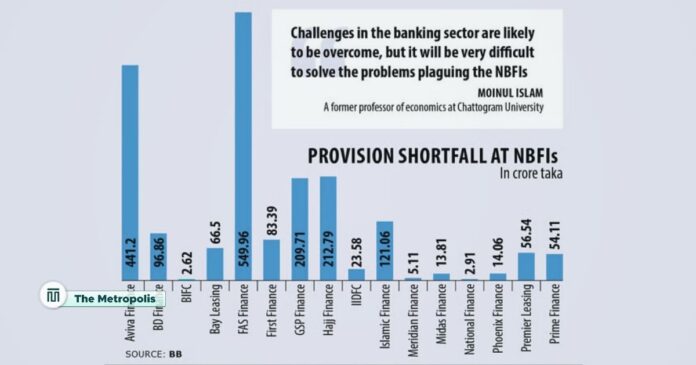

Aviva Finance, BD Finance, Bangladesh Industrial Finance Company (BIFC), Bay Leasing, FAS Finance, First Finance, GSP Finance, Hajj Finance, Industrial and Infrastructure Development Finance Company (IIDFC), Islamic Finance, Meridian Finance, Midas Finance, National Finance, Phoenix Finance, Premier Leasing, and Prime Finance are the sixteen non-banking institutions.

According to Bangladesh Bank statistics, the 35 NBFIs operating in the country were only able to manage Tk 14,122 crore out of the approximately Tk 16,023 crore that they were required to set aside as a collective until June.

Their combined provision shortfall amounted to approximately Tk 1,901 crore due to the excess provisions held by many banks.

According to Md. Golam Sarwar Bhuiyan, the chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA), the industry’s growing number of bad loans is the cause of the significant provision shortfall.

Based on data from the central bank, the amount of soured loans at NBFIs in the country up until June 2024 was a record Tk 24,711 crore.

NPLs accounted for a record 33.15 percent of the total amount they had borrowed, with Tk 74,533 crore in loans disbursed during the same period.

From Tk 19,951.17 crore in June of last year to Tk 4,760.11 crore in June of this year, there was a 24 percent year-over-year increase in sourced loans.

IIDFC’s managing director, Bhuiyan, told The Daily Star that his organization would make up the shortfall in provisions, which would be shown in the September quarterly report.

He said that the central bank gives most NBFIs some time to make up for any shortfalls.

At their most recent meeting, the governor of the central bank was addressed by the BLFCA, a forum made up of chief executives of leasing and financing companies who were asking for policy changes and liquidity support to help rebuild public confidence in NBFIs.

When massive irregularities and scams involving a lack of corporate governance rocked the sector a few years ago, consumer confidence in NBFIs reached a low point.

A central bank probe report, for example, claims that PK Halder, the former managing director of NRB Global Bank—later renamed Global Islami Bank—swindled at least Tk 3,500 crore from four NBFIs: People’s Leasing, International Leasing, FAS Finance, and BIFC.

As a result, more than 90% of the loans provided by the four NBFIs have defaulted, transforming them into failing institutions.

FAS Finance faced the most challenging situation, with a provision deficit of nearly Tk 550 crore up until June. Ninety-nine percent of the company’s total disbursed loans, totaling Tk 1,820.89 crore, were bad loans.

Following the central bank’s recent reorganisation of its board of directors to divorce it from the scandal-plagued S Alam Group, Aviva Finance failed to meet provisioning guidelines by Tk 441 crore.

With 2,354 crore Tk in non-performing loans (NPLs), the company’s loan disbursements represent 84.55% of its total outstanding debt.

Former University of Chattanooga economics professor Moinul Islam claimed that the country has far more finance companies than it needs and that the industry is completely disregarded.

The economist stated that while we expect to address obstacles in the banking industry, resolving NBFI issues will be extremely challenging.

“There should be more sector monitoring by the government and central bank. If they don’t, it will leave a significant gap in the financial sector, according to Islam.

According to BB data, among the other companies with a provision shortfall were GSP Finance at Tk 209 crore, Hajj Finance at Tk 212 crore, Islamic Finance at Tk 121 crore, BD Finance at Tk 96 crore, First Finance at Tk 83 crore, Bay Leasing at Tk 66 crore, Premier Leasing at Tk 56 crore, and Prime Finance at Tk 54 crore.

BIFC, IIDFC, Meridian Finance, Midas Finance, National Finance, and Phoenix Finance experienced a total provision shortfall of Tk 62 crore.

Everyone was focused on the banking industry, but no one was paying attention to the NBFIs, according to Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), who spoke with The Daily Star.

In addition to stating that the industry needs more development for the benefit of the nation’s economy, she said, “NBFI governance has deteriorated and must be corrected now.”