To lower inflation and boost international reserves, the Bangladesh Bank may raise the policy rate for both foreign and local currencies.

According to a finance ministry official, Ahsan H. Mansur, the recently appointed governor of the central bank, brought up the matter on Wednesday during his first meeting with Salehuddin Ahmed, the interim government’s finance adviser.

The finance consultant was meeting with authorities who were worried about the cost of necessities. The governor of the central bank, who was there, seized the chance to bring up the subject of policy rates.

The rate at which a nation’s central bank loans money to commercial banks is called the policy rate, sometimes referred to as the repo rate.

Salehuddin recently stated to The Daily Star that he had received word from the governor of the central bank that the policy rates would be reviewed. Salehuddin stated that the governor will endeavor to achieve this goal and that if the issue is not resolved, inward remittances might not rise to the anticipated amount.

According to economists, in order to counter prolonged inflation, the policy rate should be raised even more. According to the Bangladesh Bureau of Statistics, annual inflation in Bangladesh reached 9.73 percent in FY24—the highest level since FY12.

The International Monetary Fund (IMF) recommended in June that since the central bank’s monetary tightening hasn’t yet controlled inflation, it should raise the policy rate by 50 basis points by the end of the year.

While acknowledging that inflation is currently high, the statement emphasized that more tightening of monetary policy would be necessary until inflation steadily declines to the central bank’s medium-term goal range of 5–6% percent.

“The policy rate may need to increase to a peak of 9 percent by the middle of FY25 to tame inflation to 7 percent by the end of the fiscal year and bring it close to 5.5 percent by the end of FY26,” the International Monetary Fund stated.

Although the central bank did not alter the repo rate when it unveiled its monetary policy for FY25 in July, the government had promised the IMF that it would tighten monetary policy even further.

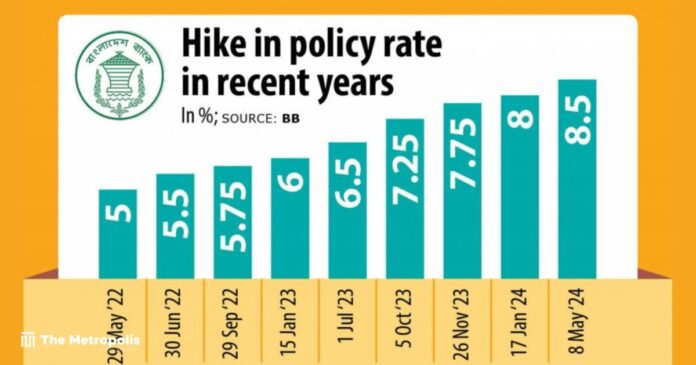

Even though the central bank raised the benchmark policy rate to previously unheard-of levels over the previous two years, making funds more expensive, it has been difficult to control inflation.

The policy rate was increased by the BB by more than 400 basis points to 8.5 percent in just two years, but inflation has not decreased.

A price shock has been caused by the deteriorating economic situation in terms of the Consumer Price Index (CPI), which takes into account inflation for both food and non-food items.

In the most recent fiscal year, the CPI increased well above the historical norm, reaching a 12-year high of 9.02 percent.

The poor and low-income groups have suffered greatly from the trend, which has persisted into the current fiscal year and is still above 9.5 percent.

In July, the CPI increased 1.94 basis points to 11.66 percent over the previous month.

Bangladesh has also been under pressure to raise its foreign exchange reserves at the same time.

The maintenance of foreign currency reserves at a specific level is one of the primary requirements imposed by the IMF on the nation in exchange for its $4.7 billion loan. Bangladesh, nevertheless, has a history of not maintaining the reserves in accordance with the requirements.

According to central bank data, as of July 31, this year, forex reserves were $20.41 billion, having decreased from $41.7 billion in August 2021.

Even though the reserves had fallen below $20 billion, a rise in the reserves was made possible by budgetary support from various development partners.

To boost foreign exchange reserves, the central bank relaxed its tight hold on the taka on May 8. It now uses a system of variable exchange rates.

The government implemented the crawling peg under this new system, which permits minor variations within a specified range.

The midpoint was set by the central bank at Tk 117 per dollar, although economists recommended raising it even higher to boost inward remittances.