The finance ministry is expected to forecast that Bangladesh’s gross domestic product (GDP) will exceed the $500-billion milestone for the first time in the upcoming fiscal year (FY) 2025-26, driven by an anticipated economic rebound.

According to finance ministry officials, this estimate was presented during a recent budget-related meeting attended by Finance Adviser Salehuddin Ahmed.

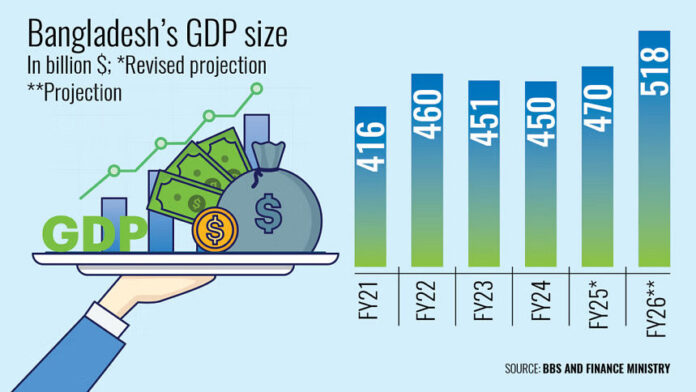

The Finance Division projects that Bangladesh’s GDP at current prices will reach $517.7 billion (Tk 6,315,923 crore) in FY26.

For the ongoing fiscal year, the initial GDP estimate was $491 billion (Tk 5,597,414 crore). However, finance ministry sources indicate that this figure may be revised downward by $21 billion to $470 billion (Tk 5,645,114 crore).

This adjustment suggests that GDP will expand by 10.21 percent at current prices in FY26 compared to the revised estimate for the current fiscal year. Meanwhile, based on the revised projection, GDP growth for this fiscal year is estimated at 4.44 percent.

In the last fiscal year (2023-24), Bangladesh’s GDP stood at $450 billion (Tk 50,026,537 crore), as reported by the Bangladesh Bureau of Statistics (BBS).

The finance ministry remains optimistic about economic recovery in the coming years, expecting GDP to surpass the $500-billion threshold.

Similarly, international financial institutions—including the Asian Development Bank (ADB), World Bank, and International Monetary Fund (IMF)—have projected stronger growth prospects, even after adjusting their economic growth forecasts for FY25 downward.

For the next fiscal year, the finance ministry may set a real GDP growth target of 6 percent, alongside an inflation rate of 6.5 percent.

“This is a realistic projection, not an overly ambitious one,” said Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh.

However, Rahman expressed skepticism about achieving the 6 percent real GDP growth target.

“Investment remains stagnant, with no visible signs of recovery in the near future,” he stated. “Additionally, development expenditures have slowed down, and there is no certainty that they will pick up in the next fiscal year.”

In its latest monetary policy, Bangladesh Bank (BB) projected private sector credit growth at 9.8 percent by June this year, aligning with the finance ministry’s revised estimate.

“This projection reflects expectations of a modest overall balance of payments surplus, driven by inflows from official multilateral development partners, sustained export revenue growth, and remittance inflows,” noted the monetary policy statement (MPS) published last week.

For the upcoming fiscal year, the finance ministry has estimated that private sector credit growth will rise to 11 percent.

Along with a steady increase in exports and remittances, the overall volume of imports is also expected to grow in the coming years.

Although import volumes remained negative until December last year, central bank data shows that overall imports rose by 3.53 percent during the July–December period.

In FY26, the finance ministry anticipates imports will grow by 10 percent.

“Considering these indicators, the government expects GDP to surpass the $500-billion mark,” said a senior finance ministry official.

Meanwhile, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), emphasized the need for the national statistical agency to reassess GDP calculations.

“Several reports, including the ‘White Paper on the State of the Bangladesh Economy,’ have pointed out inconsistencies in BBS’s GDP growth estimates,” he said.

These discrepancies, Rahman added, prevent accurate calculations of the actual tax-GDP and debt-GDP ratios.

“The BBS must first develop a more robust methodology for GDP estimation,” he stressed.