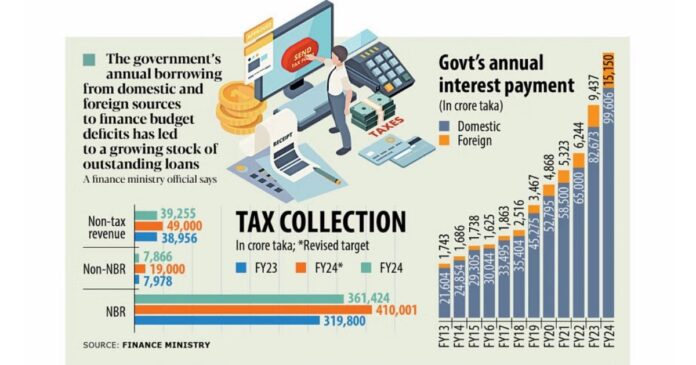

Higher borrowing rates for loans from both domestic and foreign sources caused the government’s interest payments against loans to jump by 24.5 percent in the fiscal year 2023–24, surpassing the Tk 100,000 crore mark for the first time in history.

Over Tk 114,000 crore, or more than one-sixth of the national budget, was spent on interest payments in FY24, according to the finance ministry’s fiscal report, which was made public yesterday.

The government failed to meet the revenue projections established by the International Monetary Fund (IMF) for its continuing $4.7 billion loan program, despite a small decrease in spending on subsidies.

The government’s initial budget for interest payments in FY24 was Tk 94,376 crore. However, in the amended budget, this amount increased to more than Tk 105,000 crore.

The real number, however, exceeded the increased threshold, demonstrating the government’s reliance on borrowing to cover budget deficits.

Interest payments on foreign loans rose by 60.53 percent to Tk 15,150 crore in the previous year, while interest on domestic loans jumped by 20.48 percent to Tk 99,606 crore.

The total amount of interest paid in FY23 was Tk 92,110 crore.

According to a representative of the finance ministry, the government’s yearly borrowing to cover budget deficits has resulted in an increasing amount of outstanding debts.

As of March 2024, the government’s total outstanding debt was Tk 1,697,415 crore, or 33.78 percent of the nation’s GDP.

According to the Medium-Term Macroeconomic Policy Statement (MTMPS) released by the Finance Division, interest payments would continue to progressively increase in the upcoming years.

As a result of the increased influence of external debt on the budget, the report stated that the percentage of the national budget dedicated to external interest payments would increase from 0.9 percent in FY22 to 2.6 percent in FY27.

According to the research, there were two primary variables that led to an increase in interest payments associated with foreign loans.

It also predicted that reference rates in developed economies—which act as standards for other interest rates—would stay high for a while.

Furthermore, Bangladesh will gradually lose access to foreign concessional loans once it leaves the list of least developed nations in 2026, which will increase borrowing costs.

The research stated that a higher proportion of borrowing through floating and semi-concessional rates, which are more sensitive to market fluctuations than fixed-rate financing, is the cause of this increase.

Furthermore, the value of the external debt has increased when expressed in local currency due to the taka’s depreciation versus the US dollar.

The banking industry has been the primary source of funding for domestic borrowing. The Bangladesh Bank’s recent policy rate changes have increased interest payments on domestic loans.

The administration has also encountered a fresh obstacle as a result of the recent sharp rise in subsidy spending.

As a result, the IMF has been pressuring the government to cut these costs by raising the price of fertilizer and electricity.

Compared to the updated budget, the government spent less on subsidies in FY24. The amended budget allocated Tk 85,906 crore for subsidies in total, but the actual spending was Tk 72,497 crore.

Following the IMF’s approval of a $4.7 billion loan program in January of last year, the government found it difficult to satisfy its income and foreign exchange reserve requirements. It has generally fallen short of the goals.

Consequently, to release the first three loan tranches, the government had to request a waiver.

For the fourth tranche, the IMF has set a target of approximately Tk 394,000 crore for tax revenue collection by June of this year.

At the end of the most recent fiscal year, the government’s tax income collection was Tk 369,000 crore, which falls short of the target by Tk 25,240 crore.

The government regularly failed to carry out its annual budget announcements, even if they were substantial.

We revised the budget for the previous fiscal year from Tk 761,000 crore to Tk 714,000 crore. Initially, we estimated it to be around that amount. However, the overall budget spent only Tk 602,000 crore.

The previous fiscal year saw expenditures of about Tk 574,000 crore.

The government only spent Tk 188,000 crore on the Annual Development Program (ADP) last year, despite allocating Tk 245,000 crore for it in the amended budget.

In FY23, the ADP spent Tk 192,000 crore.