Petroleum or crude oil is a type of fossil fuel, created from the remains of extinct marine animals like plants, algae, and bacteria, just like coal and natural gas. These organic remains (fossils) change into carbon-rich substances over millions of years of extreme heat and pressure.

First Discoveries:

Before the modern age, oil and gas had been utilized for thousands of years in many capacities, including as building materials and fuel for lamps. The earliest documented oil wells were dug in China in 347 AD.

Scottish chemist James Young’s discovery in 1847 marked the beginning of the oil and gas industry’s modern era. He noticed natural petroleum seepage in the Riddings coal mine, and from this seepage, he distilled both a light, thin oil appropriate for lights and a heavier oil ideal for lubricating.

In a similar timeframe, Canadian Geologist Abraham Pineo Gesner developed a cheaper, cleaner-burning liquid from bitumen, coal, and oil shale. In 1850, he gave the substance the name “kerosene” and established the Kerosene Gaslight Company. The company used this oil to illuminate Halifax city’s streets and eventually, the streets of the US.

Several new companies were formed following these discoveries, and the coal industry people were also looking to produce the oils with the processes discovered by Young and Gesner. Edwin Drake drilled the first modern oil well in the USA in 1859. Oil became one of the most valuable commodities since then.

Modern Oil Era:

During the industrial revolution, Europe and North America had fast-rising energy needs that were primarily satisfied by coal. With the advent of the first modern oil drilling, there was a growing global interest in oil from the Russian empire to Europe to North America.

This resulted in a rush of “black gold” (crude oil) in the United States, making it the largest oil producer in the world. Whale oil was replaced with distilled oil in lamps. It offered a better calorific value than coal and was easier to transport than gas. The invention of the automobile, the conversion of ship engines, and the growth of aviation during World War I – all contributed to an increase in oil consumption in the early 20th century.

Then crude oil was transported in barrels with a capacity of 42 US gallons or slightly less than 159 liters. The barrel thus became the unit for setting oil prices.

Formation of Big Corporations:

The late 18th century and the early 19th century saw the formation of the major oil companies that still dominate the oil and gas industry today.

The Standard Oil Company was established by John D. Rockefeller in 1865, making him the first oil baron in history. With control over 90 percent of America’s refining capacity and pipelines, Standard Oil swiftly rose to the top position in exploration, production, and marketing by the end of the 19th century. Today ExxonMobil is the successor company to Standard Oil.

While Rockefeller was establishing his empire in the United States, the Nobel and Rothschild families were vying for control of the extraction and refinement of Russia’s oil wealth.

The Rothschilds ordered the first oil tankers from a British trader named Marcus Samuel in quest of a global transportation network to market their kerosene. The first of these tankers was called the Murex after a particular kind of seashell, and it served as the company’s flagship after Samuel founded Shell Transport and Trading in 1897.

The late 1800s also saw the establishment of Royal Dutch Petroleum in the Dutch East Indies, and by 1892 the company had integrated its production, pipelining, and refining operations.

The Royal Dutch Petroleum Company of the Netherlands and The Shell Transport and Trading Company of the United Kingdom merged to establish Royal Dutch Shell (later known as Shell) in 1907.

Also in 1907, The Anglo-Persian Oil Company (APOC) was founded with oil discovery in Masjed Soleyman, Iran by British miner William Knox D’Arcy. To supply oil to the British Navy during World War I, the British government bought 51 percent of APOC in 1914 and later changed its name to British Petroleum (BP) in 1954.

In modern times, ExxonMobil, Shell, and BP are regarded as the first “supermajors”.

The Texas Spindletop field’s discovery in 1901 gave rise to companies like Gulf Oil, Texaco, and others in the United States. No matter where in the globe oil was produced, its price was set at that of the Gulf of Mexico during this time, demonstrating the United States’ superiority.

Oil developed into a valuable geopolitical resource and a strategic energy source after World War I. Gulf Oil, BP, Texaco, and Chevron participated in concessions that led to significant discoveries in Kuwait, Saudi Arabia, and Libya in the 1930s.

These discoveries led to the formation of a cartel of seven companies that dominated the global oil and gas industry for the majority of the 20th century. Exxon (formerly Standard Oil), Royal Dutch/Shell, BP, Mobil, Texaco, Gulf, and Chevron were collectively referred to as the Seven Sisters.

Oil Discoveries:

Around the world, more and more oil deposits were discovered, especially in Venezuela, which emerged as the second-largest producer in the world. Western companies started to enter the Middle East, where Britain already had a presence by giving a portion of their profits to the local country through royalties.

Oil demand soared during World War II, and the resource became a significant global concern. Following the battle, the United States allied with Saudi Arabia to get exclusive access to its oil in exchange for providing security to Saudi Arabia.

Nationalism:

Western dominance in petroleum production instigated nationalist movements in petroleum-producing countries. Saudi Arabia signed an agreement so the nation can earn 50 percent of the proceeds from oil sales.

Iranian oil was nationalized by the Shah after failed discussions with the Anglo-Persian Oil Company. In reaction, the US and the UK planned a failed coup to remove the Shah in secrecy. While still in power, the Shah of Iran permitted a group of Western corporations to utilize the country’s oil reserves.

In the USSR, the discovery of oil reserves in Western Siberia encouraged the nation to invest in their exploitation.

The OPEC Era:

Beginning in the 1950s, several changes took place that gave oil-producing nations more control over production and pricing. At that time, oil replaced coal as the main source of energy in the globe due to its abundance and low cost. Its pricing was less than 3 US dollars a barrel. Under these circumstances, five major oil-producing countries decided to unite to drive more benefits such as increasing oil prices and having a common policy.

The governments of Venezuela, Saudi Arabia, Kuwait, Iraq, and Iran established the Organization of the Petroleum Exporting Countries (OPEC) in 1960 to represent their newly acquired power and to engage in negotiations with Integrated Oil Companies (IOCs) on oil output, oil pricing, and potential concession rights.

OPEC viewed the IOCs as agents of their home countries (usually the U.S. or European countries). Hence, they started asserting their authority for control of their countries’ oil and gas resources for both economic and geopolitical reasons.

OPEC’s initial 10 years of existence saw little impact. However, early in the 1970s, during the fourth Arab-Israeli war, Muammar al-Gaddafi’s renegotiation of the conditions in Libya, and the increase in energy consumption caused the tide to change. During this period, The United States also hit its peak oil output and had to import oil to meet its rising demand.

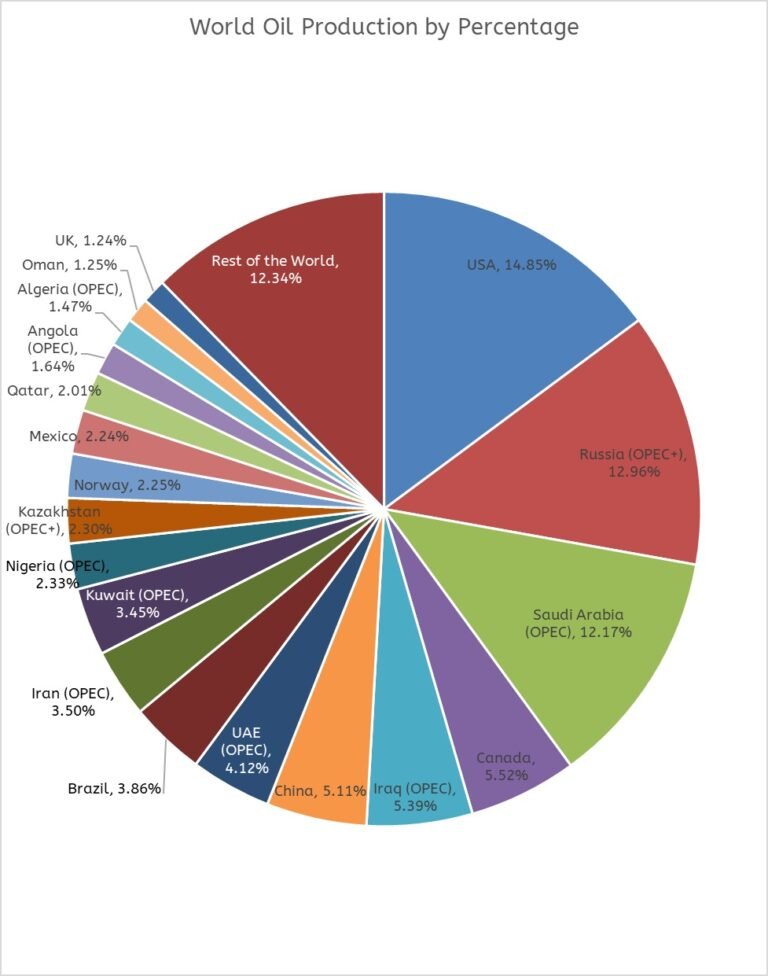

OPEC was established, in part, as a reaction to Western oil companies’ attempts to lower oil prices. By coordinating pricing and policies, OPEC has enabled oil-producing nations to secure their revenue and prestige in the eyes of the international community. Today, members of OPEC are Algeria, Angola, the Republic of the Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates, and Venezuela.

To further tie policy goals between OPEC and non-OPEC members, several non-OPEC member countries also participate in the organization’s programs, such as voluntary supply cutbacks. Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, the Philippines, Russia, South Sudan, and Sudan are included in this loose alliance of nations known as OPEC+.

The emergence of OPEC not only signaled the start of the current National Oil Company (NOC) era but also shifted control of production and pricing from Western IOCs to producing countries.

The Oil Crisis:

Following the Yom Kippur War between Israel and the Arab nations of Egypt, Syria, and Jordan in 1973, OPEC used oil as a political tool for the first time. An oil embargo was imposed on Israel’s partner nations, and output was reduced to drive up oil prices. This, known as the first oil crisis, affected the developed nations significantly whose economies were dependent on this “black gold”. Countries started working on lowering their oil usage and reinvesting in coal or investing in alternatives like nuclear and hydropower.

Major oil companies started exploring new locations. Offshore sites, or sources at sea, were found and exploited, mainly in the North Sea. The United States increased its production with Alaskan oil exploitation. At this time, the USSR emerged as the world’s top oil producer.

Meanwhile, the Iranian Revolution occurred in 1979. The Islamic Republic was established overthrowing the monarchy. With the adoption of an anti-Western stance, they decreased domestic oil production. This resulted in the second oil crisis.

Middle East Instability:

Tensions between Iran and Iraq over border issues resulted in an eight-year conflict (1980-88). Oil production by non-OPEC nations kept increasing and surpassed that of OPEC nations globally. From this point forward, instead of OPEC, only supply and demand determined the price of a barrel.

Nevertheless, Middle East’s stability was still important to industrialized nations. When Iran and Iraq started to strike each other’s oil infrastructure in the Persian Gulf, hundreds of Western military ships intervened to ensure the delivery of oil. At the end of the war, Iraq was severely weakened and indebted to Saudi Arabia and Kuwait.

However, the nation possessed the strongest force in the region due to large-scale military equipment donations. Following a border disagreement, Iraq used this opportunity to attack Kuwait. To intervene and destroy the Iraqi army, a global coalition was established under the auspices of the UN and was headed by the United States.

US Intervention:

The United States installed military bases and signed defense pacts with Gulf monarchies to build a long-term presence in the region. The nation enforced several embargoes on Iran and Iraq since they were seen as rouge states.

At this time, Saudi Arabia, with the largest known oil reserves in the world then, aimed to resume its position as the top oil producer by flooding the market with petroleum.

Simultaneously concerns were growing over the US military involvement in the Middle East. On one hand, extremist Islamists opposed having an Israeli ally on their territory. On the other hand, some believed that the restrictions imposed on Iran and Iraq were too heavy.

After the World Trade Center terrorist attack on 11th September 2001, allegedly blaming Saudi Arabia for the massacre, The United States actively started looking for alternative oil sources to lessen its reliance on Saudi Arabia and invaded Iraq in 2003 under the guise of fighting the spread of weapons of mass destruction.

The National Oil Company (NOC) Era:

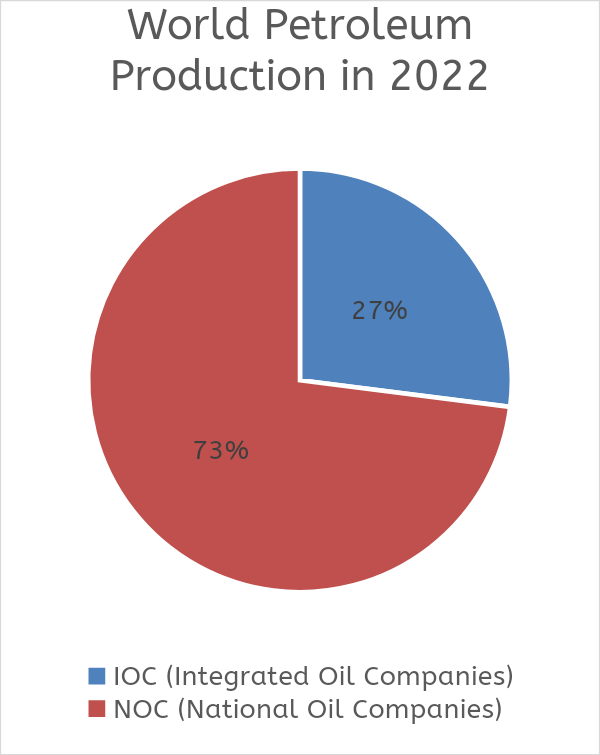

National oil companies started to become increasingly dominant as a result of decreasing supply, rising demand, high crude oil and natural gas prices and shifting geopolitical conditions.

After emerging as the nation with the largest proven oil reserve in the world, Venezuela President Hugo Chavez decided to end production agreements and other kinds of cooperation with Integrated Oil Companies (IOCs) in 2007. The government strengthened its control over PDVSA’s (The National Oil Company of Venezuela) present output and access to reserves.

Russia also did a similar thing by reinforcing Gazprom’s dominance to the point that it had broken agreements with IOCs.

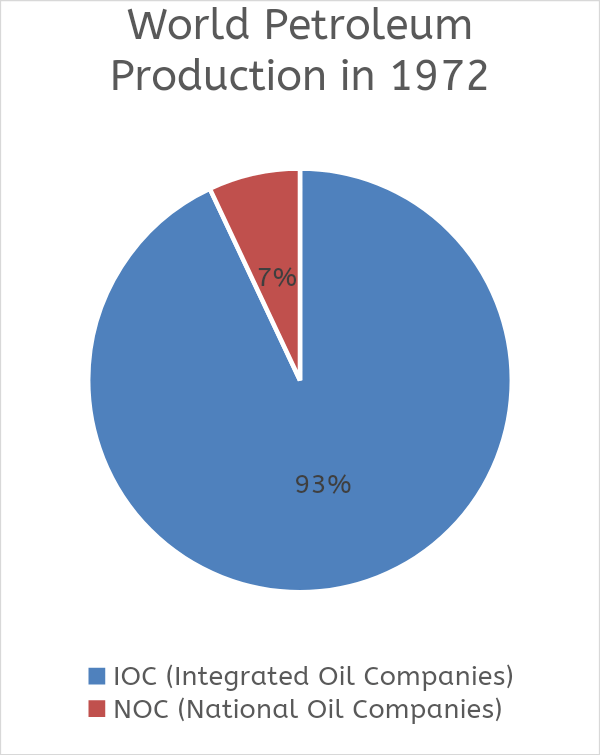

There has been a remarkable shift in the balance of power in the international oil and gas industry. In 1972, IOCs and major independents produced 93 percent of the world’s petroleum production while NOCs produced only 7 percent. Today, the situation has completely turned around, with NOCs now in control of 73 percent of the global oil and gas production market.

New Sources and the Unconventional Era:

The North American energy environment has changed over the past 15 years with technological advances in unconventional oil and gas extraction. Significant innovations in subsea engineering (particularly deep-water production), and hydraulic fracturing have created vast new production opportunities around the world.

Fracking, also known as hydraulic fracturing, is the procedure of injecting sand, chemicals, and water into wells so nearby shale rock formations get fractured, allowing hydrocarbons to escape. This process has initiated a boom in North American oil and gas production with lower oil exploitation costs.

However, in the political and environmental arenas, fracking has always been controversial due to the process being extremely water-intensive. Fracking a single well can require up to 5 million gallons of water.

There have been raising concerns about the possibility of depleting water supplies and requiring water purchases. Environmental concerns for local populations also include the handling of used “frack water” as well as the impact of chemicals in fracking fluid on groundwater reserves.

Despite these worries, US oil and gas production is higher than at any time now in the last 20 years. As nations turn to domestic production and energy independence, they are also keeping a close eye on these developments to break the dominance of OPEC or the others.

Price War:

OPEC has been engaged in a pricing war against American and European oil producers since its inception. Oil can be cheaply extracted in Middle-Eastern counties like Saudi Arabia and Kuwait. But in the US states like Texas and North Dakota, oil extraction from shale formations is more expensive. Hence, OPEC often allows oil price fall to force the closure of many of the newest drilling operations in the US or Europe.

If the price of oil declines, some US or European producers may risk losing money and going out of business. The outcome? Oil prices will level off, and OPEC will continue to dominate the market. The problem is that nobody is quite sure yet how cheap prices need to be to stop the US or European shale boom.

Post-Covid Era, Russia-Ukraine War, and Oil Price:

Oil prices were having an increasing trend in the post-Covid era due to increased demand sparked by the world economies’ recovery. However, Russia’s invasion of Ukraine just caused the crude oil price to skyrocket from around 76 US dollars per barrel at the start of January 2022 to over 110 US dollars per barrel on March 2022. The sanctions’ restrictions on access to Russian oil only increased demand, pushing the oil price even higher.

Russia is making even more money now from crude oil sales than it was making before the war started. Many Asian countries, including India, China, Japan, Korea, and Turkey have stepped in to acquire cheap crude from Russia.

Oil Prices by Year – Average, High, Low, and Events:

The Future:

We presently have enough oil to last for at least another 50 years at current rates, although IPCC (Intergovernmental Panel on Climate Change) experts are raising the alarm and advocating for dramatically decreasing carbon dioxide emissions to stop global warming.

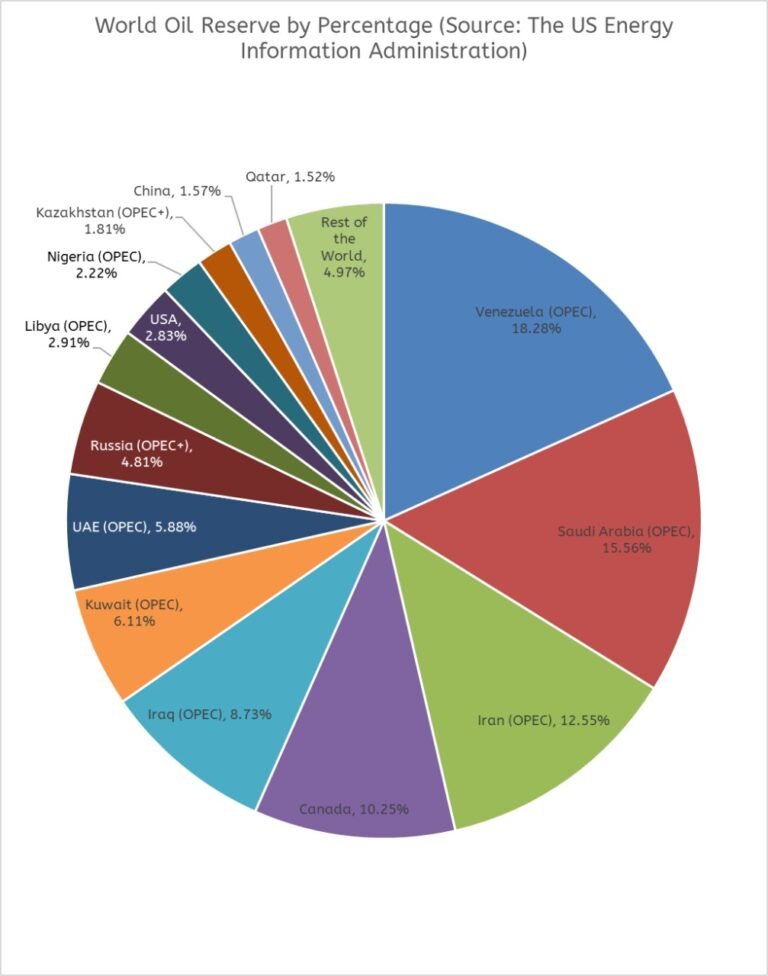

Following the demise of Hugo Chavez, Venezuela has been suffering from years of mismanagement and political purges along with the dismantling of PDVSA’s (The National Oil Company of Venezuela) managerial structures so the sector never completely reaps the rewards of its vast reserves (the highest in the world).

To get ready for the post-oil era, Saudi Arabia, the country with the second-highest reserve in the world, now talks of diversifying its interests.

Iran, which has the third-largest oil reserves in the world, has been affected by sanctions put in place by the US since 2018 to stifle its oil exports.

In 2020, the International Maritime Organization (IMO) set regulations for ships to have significantly lower sulfur emissions. This has driven the sector to switch from heavy fuel oil to other hydrocarbons, which in turn has increased the demand for and cost of it.

With the rise in oil prices, exploration for unconventional petroleum may resume with renewed enthusiasm. This includes regions like the Arctic, which has the potential to retain enormous reserves. In addition, the melting of the polar ice caps makes it possible to explore new oil-rich regions.

Ehsanul Kabir, Ph.D. is a petroleum engineer, working as the Senior Lecturer at the University of Texas – Permian Basin in the USA

What a brilliant article! We are grateful for this writeup😀