Metropolis Desk-

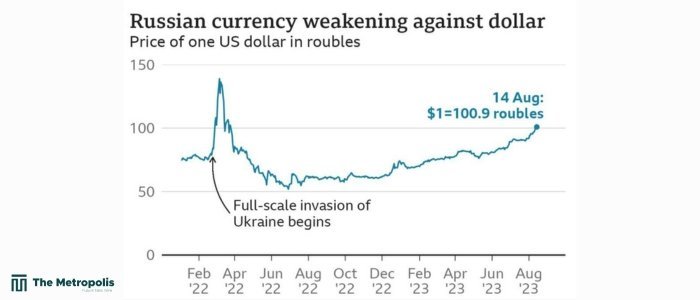

The value of the Russian rouble has reached its lowest point in 16 months and surpassed 100 against the US dollar.

The drop occurs as pressure on the Russian economy mounts as military spending for the Ukraine war increases and imports grow faster than exports.

Western nations have imposed sanctions on Russia as a result of its invasion of Ukraine in February 2022.

After the war initially started, the rouble fell but was later supported by capital controls and oil and gas exports.

The value of the Russian rouble has reached its lowest point in 16 months and surpassed 100 against the US dollar. The drop occurs as pressure on the Russian economy mounts as military spending for the Ukraine war increases and imports grow faster than exports.

Western nations have imposed sanctions on Russia as a result of its invasion of Ukraine in February 2022.

After the war initially started, the rouble fell but was later supported by capital controls and oil and gas exports.

Despite stating that it sees no threat to the nation’s financial stability, the central bank of Russia has indicated that a crucial interest rate increase is possible.

The bank increased rates from 9.5% to 20% when Russia invaded Ukraine, but soon started lowering them.

The rouble has been “weakening gradually” this year, according to Jane Foley, managing director at Rabobank London, who also noted that “the pace has picked up since late July.”

She continued, “The rouble’s weakness reflects a weakening fundamental backdrop in Russia,” noting that the nation’s budget was in deficit and that it was dependent on imports from Turkey and China but was under pressure to increase exports.

Russ Mould, investment director at AJ Bell, said that Russia’s trade, and therefore its economy, was being hit by Western sanctions, “especially for oil and gas”.

Since the outbreak of war, many EU countries which relied on Russian oil and gas have pledged to wean themselves off imports from the country and find alternative suppliers.

In December 2022, G7 and EU leaders introduced a price cap plan aimed at limiting the revenue Russia earns from its oil exports, by trying to keep it below $60 a barrel. This has played a part in the value of Russia’s exports for oil dropping.

Russia also turned off the gas taps to Europe, leading to fears of blackouts. In January, Germany, once a large importer, said it no longer depended on the country’s fossil fuels for its energy supply.

Inflows of hard currency are decreasing due to decreased exports, while imports are increasing and even dependable trading partners like China seem unwilling to accept roubles, according to Mr. Mould.

Moscow had also been impacted by Russia’s absence from Swift, a global payment system used by thousands of financial firms.

However, Mr Mould said that the “weakness of the rouble must also be set against the strength of the dollar,” with the dollar “gaining ground against emerging currencies across the board.”

He claimed that part of the reason for this was the robust US economy, which “is forcing the Federal Reserve to raise interest rates in contrast to many emerging central banks, which are starting to cut (particularly Brazil and Chile),” according to him.

“Higher returns on cash in dollars and lower ones in other currencies can increase the relative attractiveness of holding greenbacks, or assets denominated in them,” Mr Mould continued.

Source- BBC News